Decolonizing the International Tax System

Africa's win for the Global South: The UN Framework Convention on Taxation

Greetings from Accra, Ghana!

It’s been a hot, humid, and wonderful week in Accra. I gave a keynote speech at the 11th Pan-African Conference on Illicit Financial Flows and Taxation (Nov. 22-24). The title of my speech was “A Pan-African Vision for Structural Transformation: We can’t decarbonize a system that hasn’t been decolonized yet.” You can watch the video here, including the very insightful panel discussion with my dear colleagues Mukupa Nsenduluka (Tax Justice Network Africa), Titus Gwemende (Open Society Foundations), Jason Braganza (AFRODAD), Natalie Mwila (Center for Trade Policy and Development). and concluding remarks by Dr. Patrick Olomo Ndazana (African Union Commission). This was for a session titled “The International Financial Architecture and Africa’s Extractive Industry: Answering the Climate Change Question.”

Coincidently, the conference turned into a celebration of years worth of hard work by African tax justice leaders, scholars, and activists. On November 22, 2023, sitting in that conference hall in Accra, we watched the live vote at the United Nation in New York. Here is the full text of the resolution that effectively starts a process of establishing a democratic intergovernmental UN-based international cooperation on taxation. It was a historic moment for the Africa Group standing together with a broad Global South unity to begin the process of decolonizing the international tax system A system that was not established by us or for us, cannot be the system that will deliver justice or equity for us. The current international tax “cooperation” system is housed with the OECD, which is essentially a Global North dominated club that gives no voice to Africa and the rest of the Global South.

The lead up to this historic vote was marked by an aggressive campaign of obstruction, manipulation, and intimidation, including a last minute attempt by the United Kingdom to dilute the draft resolution with an amendement that would essentially neutralize Africa’s effort to decolonize the international tax system and to structurally address the illicit financial flows problem, these are financial flows that move from the Global South to the Global North (hence the hypocrisy of the OECD. This also explains why the tax havens voted agains the UN Tax Convention resolution).

It worth mentioning that Colombia was the only OECD country that not only voted for the resolution, but also played a key role in bringing key countries from across the Global South to unite behind the Africa Group in this historic effort. This victory is the first step in a long and difficult struggle to decolonize the global economic architecture, including the international finance, trade, investment, and tax architecture. Here is the African Union statement about the UN Tax Convention vote.

Predistribution, not Redistribution

In the tax justice movement and in progressive movements in general, we tend to have this well-meaning intuition to focus on re-distribution. We want to tax the rich to give to the poor; tax polluters to fund green investments; tax gambling to fund schools; tax smoking to fund hospitals; tax speculation to fund social programs, and the list go on. There is a fundamental problem with this logic.

This logic guarantees that if you succeed in taxing the “sins” out of existence then we’re killing the source of funding the good stuff. If smokers stop smoking (which is a good public health outcome), we end up killing the revenue stream for hospitals, but if more people smoke, then we have decent funding for public hospitals. We want to tax and regulate polluters out of existence. If we tax them for the purpose of funding, then we would want them to become bigger, more profitable, and therefore, more economically and politically influential, which ensures that they will use their power to block all efforts to decarbonize. We need to decouple the taxing from the spending. Tax polluters out of existence, not because we need their money or their permission the have clean air, water, soil and to have a sustainable and prosperous economy.

Furthermore, re-distribution means that accept the existing engines of the economy that produce inequality, injustice, exclusion, and pollution, then struggle to correct its effects and fight against powerful vested interest groups to tax a bit of their ill-gotten wealth to compensate the victims of this abusive system. What we need to do is to change the very engines that produce these negative effects in the first place, and replace them with new engines that produce equity, justice, inclusion, and prosperity for all by design. That is to say, we need a system that pre-distributes wealth the correct way, by design.

African Youth for Tax Justice

I had the pleasure of attending a youth-led panel organized by Youth For Tax Justice Network. It was an amazing showcase of African youth, their talent, creativity, passion, and commitment to Africa’s transformation and for economic justice. The panel featured their creative work during the campaign for the UN Tax Convention. With their permission, I am sharing a handful of the videos, poems, and graphics that they produced. They have inspired all of us and they gave us a lot of hope, and made us very proud.

Here is a video and poem by Petronilla Nduku Kyalo from Kenya.

Here is a poem by Jessica Aspara from Namibia.

Here is a poem and a video by Nansubuga Jemimah from Uganda.

Here is a graphic design by Erick Kiarie from Kenya.

Here is a poem and video by Shingirai Manyengavana from Zimbabwe.

Here is a poem and a video by Rotich David from Kenya

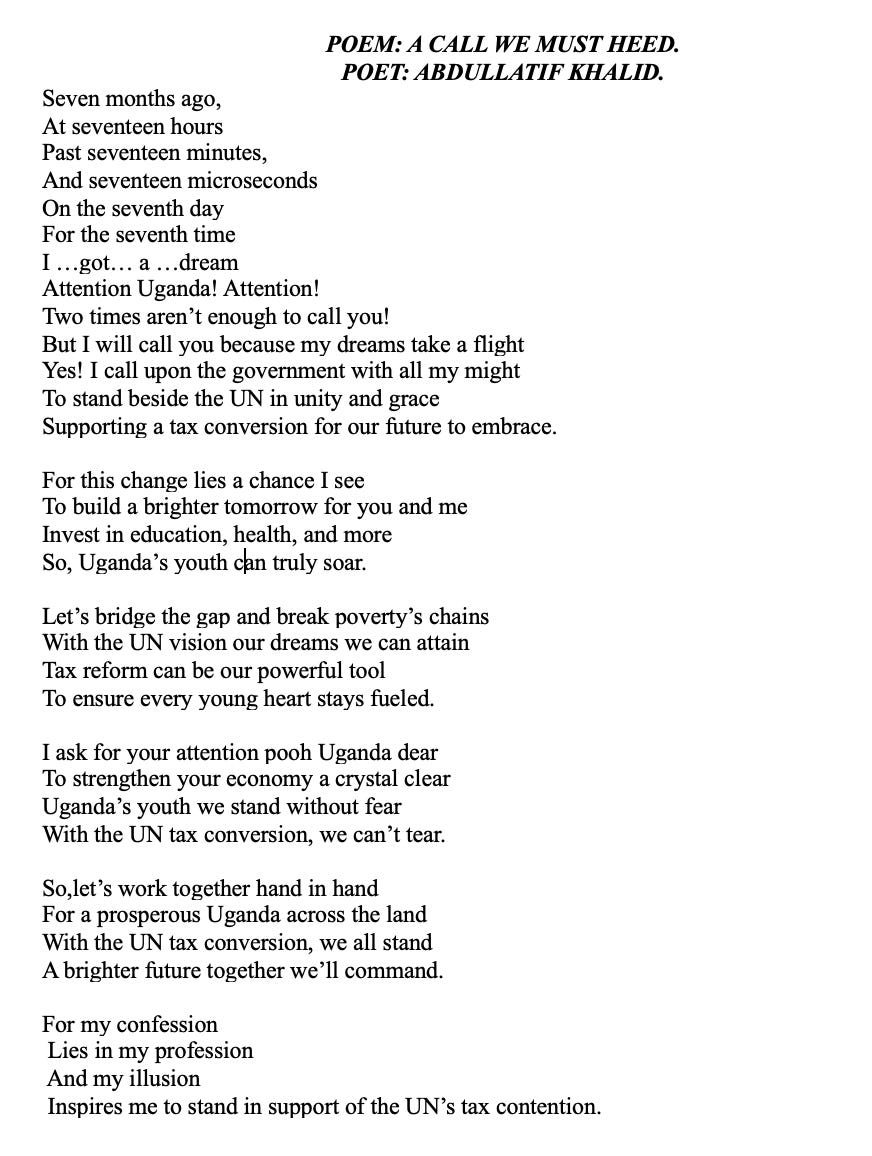

Here is a poem by Abdullatif Khalid from Uganda.

Fadhel Kaboub is an associate professor of economics at Denison University (on leave), and the president of the Global Institute for Sustainable Prosperity. He is also a member of the Independent Expert Group on Just Transition and Development, and serves as senior advisor with Power Shift Africa. He has recently served as Under-Secretary-General for Financing for Development at the Organisation of Southern Cooperation in Addis Ababa, Ethiopia. Dr. Kaboub is an expert on designing public policies to enhance monetary and economic sovereignty in the Global South, build resilience, and promote equitable and sustainable prosperity. His recent work focuses on Just Transition, Climate Finance, and transforming the global trade, finance, and investment architecture. His most recent co-authored publication is Just Transition: A Climate, Energy, and Development Vision for Africa (May 2023, published by the Independent Expert Group on Just Transition and Development). He has held a number of research affiliations with the Levy Economics Institute (NY), the John F. Kennedy School of Government at Harvard University (MA), the Economic Research Forum (Cairo), Power Shift Africa (Nairobi), and the Center for Strategic Studies on the Maghreb (Tunis). He is currently based in Nairobi, Kenya and is working on climate finance and development policies in Africa. You can follow him on Twitter @FadhelKaboub and you can read his Global South Perspectives on substack where he blogs regularly.

Amazing news about the tax convention!

And "Predistribution, not Redistribution" is such a key theme for the post-neoliberal era.

A global tax would be ideal! But we should also advocate for businesses to invest directly in the UN 17 Sustainable Development Goals. In June 2023, Bank of America Chair & CEO, Brian Moynihan spoke about the state of the economy, the U.S. financial system, and capitalism. * He said, ‘the SDGs will cost approximately’ “$6 trillion annually”. “Governments are too debt burdened” and “charity is insufficient”. “Business leaders” “like the oil companies” and others need to step up and prioritize a balancing of ‘short-term gains’ with ‘long term interests'. ‘Profits must be good for business and society down to the community level’. “Capitalism” “requires a greater purpose than making more profit.” Neither are sustainable without these SDG goals being achieved. * Interview hosted by the City Club of Cleveland. Posted on C-span. Program ID: 529044-1 https://www.c-span.org/video/?529044-1/bank-america-ceo-remarks-city-club-cleveland If supporting this effort to increase US business please email 435campaign@earthlink.net